Bogota's Bakery Sector: An economic overview

So today we are going to analyze and to make and in-deep research about the bakery sector in the capital city of Colombia, Bogotá. It's clear enough the market is lead by several companies, however: it could be useful if we take a look to the reality and some indexes in order to figure out what's going on with this sector in the city. So let's take a look:

First, it's important to identify the lead firms by patrimony, and this is because patrimony means obligations and duties with the partners. In this field Productos Ramo is the largest with a total amount of 181 billion COP, which is roughly 48 million dollars as we can see as follows (Source of info: data publicly available from superintendences and others) :

Why if we take a look to the frecuency in patrimony? well, naturally patrimony distributes along 181 billion COP and zero. However, the main aspect we could highligth is the fact that most of the firms have got patrimony under 10.000 million COP having the main part of the firms low amounts of patrimony. I mean, little firms take up most of the market as we can see as follows:

Now, assessing firms by total assets (which according with the website wallstreetmojo.com it's defined as "assets owned by the entity that has economic value whose benefits can be derived in the future") we realize that productos ramo, alimentos polar, and zona franca Pir S.A.S. are respectively the three largest firms in the market in Bogota's area by total assets. Down below you can find a plot with the 20 largest companies by this index according with some data avaiable publicly.

For policymakers is important to take into account the impact of firms on citizens' well-being, I mean, how many people any firm hire in a certain period of time. Naturally, largest firms hire a great amount of people, however, it depends on the firm tecnhology of production and the bussiness model among other things. In this case, firms such as Pan Pa Ya hire a larger amount of people than other bigger companies, even though it isn't the second largest company by total assets nor by patrimony as we see:

Now, if we consider the performance of firms in this industry by its operating profit margin we realize that, it isn't necessary true that largest firms have the largest profit margins. So let's take a look to this index which represent the profti of a dollar in sales, taking into account several costs like wages and raw materials but before paying taxes and interests according with the website of Investing.com (https://www.investopedia.com/terms/o/operatingmargin.asp) as we can see as follows:

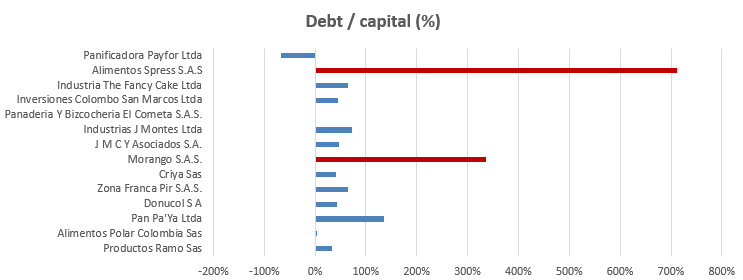

Now, in terms of the risk that represent the level of leverage in any company, we take a look to the relationship between long.-term debt and total equity, I mean the sum of debt and own resources (patrimony). In specific, debt can bet divided into two principal accounts: long-term debt and short-term debt which by the way mean interest (Acoording with the website Economipedia.com https://economipedia.com/definiciones/ratio-de-deuda-sobre-capital.html) as we see:

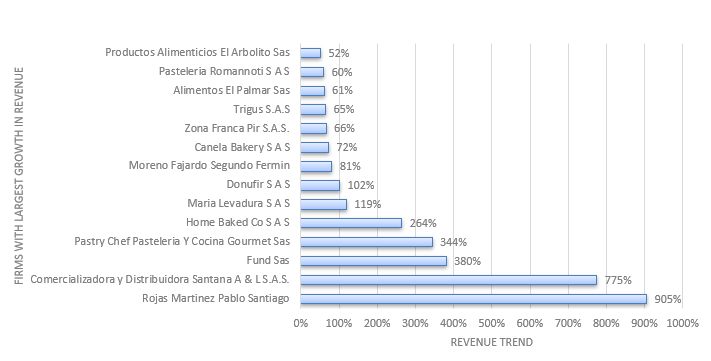

Meanwhile, some firms show incredible high revenue trend reaching 900% according with the Bogota chamber of commerce data. The firms with largest revenue trend is show down below:

Let's talk a little bit about the ROE of the industry. First ROE (Return on equity) represent the financial performance calculated as the proportion of the net income with relation to the total patrimony. So now, let's take a look to largest ROE's among companies in the industry:(The red line represent the average ROE in the industry and overally a greater ROE mean a better performance of any firm).

Comentarios

Publicar un comentario