Analyzing a particular fashion firm

Hi everyone! Today we're gonna analyze the financial statements of a particular fashion firm, the name doesn't care for our purposes, I just have to tell you guys that isn't small whatsoever in the industry. So let's begin:

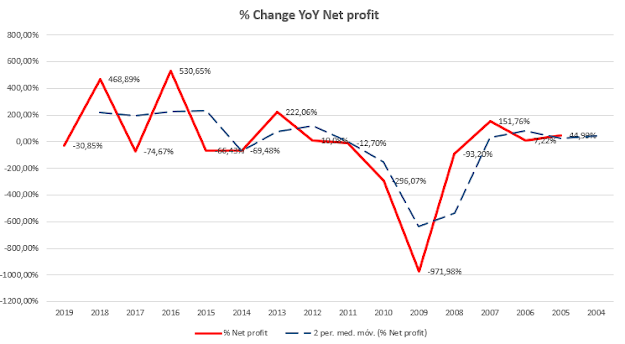

So this is the net profit behaviour year over year, it's interesting how we see a deep fall in the net profits during the crisis but also that in recent years the net profit has been going up and down showing maybe some changes in demand and macroeconomic context during these years...who knows? let's take a look to figure it out.

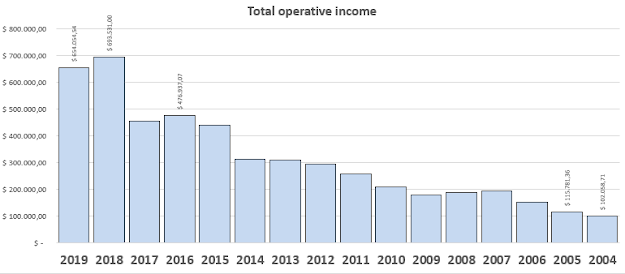

What about the income? you shoudl keep in mind that these values are totally real, so we can see a pretty volatile overview showing sharply falls and climbs in the percent of change of the income, feeling curoius how big this company is? well...let's take a look of the annual income in absolute values:

Yeah so in 2019 the total operative income of the firm we're focusing on was roughly 700 thousand million COP which is (By current Exchange Rate 195 million dollars). So now let's talke a look to other index to measure the efficiency of the firm:

The relationship between receivable and payable accounts is good by and large. However, in recent years, the money spent in payable accounts started to rise sharply so the receivable too but in a less rate of growth. What's going on? maybe the time to pay the raw materials, the customers and so on have changed in a important way. Furthermore, what's causing that the receivable account plunged from 120.000 million COP in 2014 to only 18.000 million COP in 2016?

The last year was the one when the company paid most taxes following a "weird" trend of relative low taxes paid in spite of the fact that lately the taxes had been going up and in 2017 just plunged.

Comentarios

Publicar un comentario